The process of identifying real-estate property or building components that will generate accelerated depreciation deductions and federal tax deferrals

Federal tax incentives that promote the construction of energy efficient residential and commercial buildings

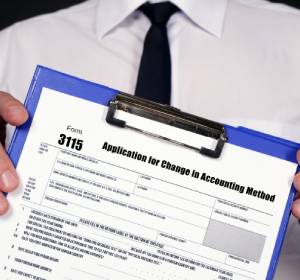

The form used to request approval from the IRS to make a change to your overall method of accounting

Federal tax credit for US companies to increase spending on research and development in the US or use alternative energy resources

IRS approved payroll tax reduction program which reduces payroll taxes for employer and employee

Holistic tax planning providing a comprehensive approach to tax strategies maximizing your after-tax income

Specialized type of 1031 exchange that involves careful, strategic planning and analysis to optimize the tax benefits of deferring capital gains taxes on real estate transactions

Provides professional outsourced back-office talent and bookkeeping staff to support gaps in your team

Your CPA doesn't cover IRS penalties – InsureTax does. Up to $750K coverage per policy. IRS Audit Insurance – backed by Lloyd's. Never Fear Tax Again.

Nationwide Trusted Advisors to CPA's, Businesses, & Real Estate Investors.

Optimize your tax benefits with Pacific Investment Holdings and propel your profitability!